The Main Principles Of Transaction Advisory Services

Some Known Factual Statements About Transaction Advisory Services

Table of ContentsThe Buzz on Transaction Advisory ServicesThe Only Guide for Transaction Advisory ServicesAn Unbiased View of Transaction Advisory ServicesA Biased View of Transaction Advisory ServicesThe Facts About Transaction Advisory Services Revealed

This action makes certain the service looks its ideal to potential customers. Getting the company's value right is critical for a successful sale.Transaction consultants action in to aid by getting all the required details arranged, answering inquiries from purchasers, and arranging brows through to the service's area. This constructs count on with customers and maintains the sale moving along. Obtaining the most effective terms is vital. Deal consultants utilize their knowledge to assist service owners handle difficult arrangements, satisfy purchaser assumptions, and framework bargains that match the proprietor's goals.

Satisfying lawful policies is essential in any kind of service sale. Transaction advising solutions work with lawful specialists to develop and review contracts, agreements, and other lawful papers. This reduces threats and sees to it the sale follows the legislation. The role of transaction experts expands beyond the sale. They assist service owners in preparing for their following actions, whether it's retired life, starting a new venture, or handling their newfound wide range.

Deal experts bring a wealth of experience and understanding, making certain that every aspect of the sale is managed properly. With calculated prep work, valuation, and arrangement, TAS assists company owner attain the highest feasible price. By making certain lawful and regulative conformity and handling due diligence together with various other deal team members, deal advisors reduce potential risks and obligations.

Getting The Transaction Advisory Services To Work

By comparison, Large 4 TS teams: Work on (e.g., when a prospective customer is performing due persistance, or when a bargain is shutting and the customer requires to incorporate the business and re-value the seller's Annual report). Are with charges that are not connected to the offer closing successfully. Make charges per involvement someplace in the, which is much less than what financial investment financial institutions gain also on "little deals" (yet the collection probability is additionally much higher).

, however they'll concentrate a lot more on audit and valuation and much less on topics like LBO modeling., and "accounting professional only" topics like trial balances and exactly how to walk through events making use of debits and credit scores rather than financial statement changes.

The 45-Second Trick For Transaction Advisory Services

Specialists in the TS/ FDD teams might additionally talk to management concerning every little thing above, and they'll create a comprehensive report with their findings at the end of the process.

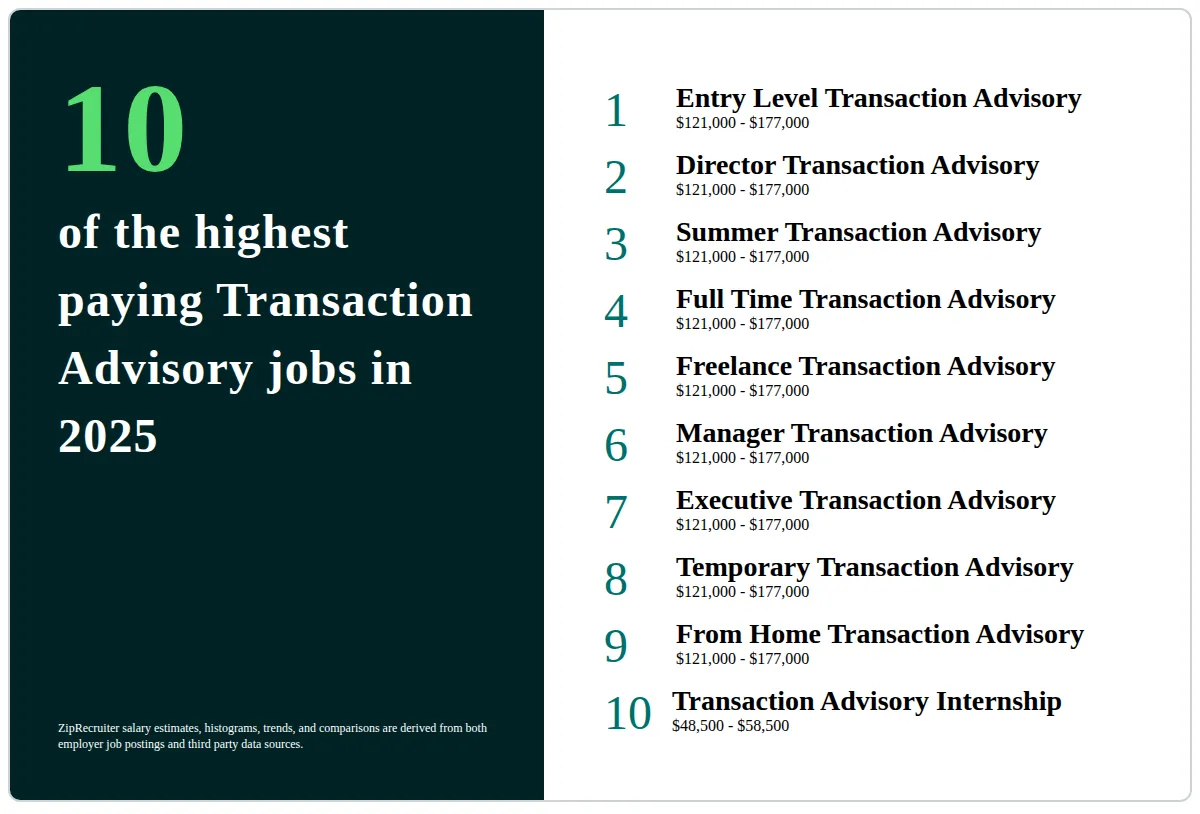

The pecking order in Purchase Providers differs a bit from the ones in financial investment financial and personal equity jobs, and the general shape appears like this: The entry-level duty, where you do a whole lot of data and economic analysis (2 years for a promotion from below). The following degree up; comparable job, however you get the even more fascinating bits (3 years for a promotion).

In certain, it's difficult to get promoted beyond the Supervisor degree since couple of individuals leave the task at that stage, and you need to begin revealing proof of your capability to produce profits to advance. Allow's begin with the hours and way of life considering that those are less complicated to describe:. There are occasional late nights and weekend work, but nothing like the frantic nature of financial investment financial.

There are cost-of-living changes, so expect reduced settlement if you remain in a less expensive area outside major financial facilities. For all positions except Partner, the base salary consists of the bulk of the total compensation; the year-end benefit could be a max of 30% of your base income. Commonly, the most effective means to raise your incomes is to change to a different company and negotiate for a greater salary and benefit

Excitement About Transaction Advisory Services

At this phase, you need to simply remain and make a run for a Partner-level function. If you desire to leave, possibly relocate to a client and do their evaluations and due click this site diligence in-house.

The main problem is that since: You normally need to sign up with one more Huge 4 team, such as audit, and work there for a couple of years and after that relocate into TS, job there for a few years and get more after that relocate right into IB. And there's still no guarantee of winning this IB role since it depends on your area, clients, and the hiring market at the time.

Longer-term, there is also some danger of and since examining a company's historic monetary information is not specifically rocket science. Yes, human beings will certainly constantly require to be included, yet with advanced technology, lower headcounts might possibly sustain customer interactions. That stated, the Deal Services group beats audit in terms of pay, work, and departure possibilities.

If you liked this article, you could be interested in reading.

Unknown Facts About Transaction Advisory Services

Create sophisticated financial frameworks that aid in determining the actual market worth of a firm. Offer consultatory operate in relationship to business evaluation to aid in bargaining and rates frameworks. Clarify one of the most appropriate kind of the bargain and the sort of factor to consider to use (cash, stock, gain out, and others).

Develop action prepare for threat and direct exposure that have actually been identified. Execute assimilation planning to identify the process, system, and organizational adjustments that may be called for after the deal. Make mathematical estimates of combination costs and benefits to analyze the financial rationale of integration. Set standards for incorporating departments, modern technologies, and business procedures.

Determine possible decreases by lowering DPO, DIO, and DSO. Evaluate the prospective client base, market verticals, and sales cycle. Take into consideration try this web-site the possibilities for both cross-selling and up-selling (Transaction Advisory Services). The operational due persistance provides vital insights into the functioning of the firm to be gotten concerning danger assessment and worth development. Determine short-term adjustments to finances, financial institutions, and systems.